Business Partner

China

China

New Zealand

New Zealand

In Australia, Aurec Capital has invested in high-end and luxury residential projects built by distinguished developers. The group also owns 260 square kilometers of agricultural land in Queenstown, New Zealand used both for agricultural farmland as well as for tourism development.

Aurec Capital undertakes various initiatives from real estate to venture capital; each arm and industry is as diverse as our people, and stand at the core of our vision to create meaningful success to our businesses and to our partners.

3 Hayetzira st

Ramat Gan, Israel

T. +972 3 610 2929

F. +972 3 610 2928

info@aurec-capital.com

www.aureccapital.com

655 Third Ave.

New York, NY 10017

T. +1 212 230 1210

F. +1 212 230 1216

Bleibtreustraße 41, 10623 Berlin, Germany

T. +49 30 69 200 1010

F. +49 30 69 200 1019

office@aurecre.de

www.aurecre.de

Próżna 7/9 st., 00-107 Warsaw, Poland

T. +48 22 395 8600

office@aurec-capital.pl

www.livup.pl

Aurec Home Holding sp.z.o.o

02-231 Warszawa, Jutrzenki 111A Street

T. +48 500 546 466

office@aurechome.pl

www.aurechome.pl

38F, Park Place, 1601 West Nanjing Road

Shanghai, P.R. China

T. + 86 21 6171 3776

info@aurec-china.com

www.aurec-china.com

Private Equity

TELECOMMUNICATION

The Intersection New York project is at the forefront of the Smart City Revolution, harnessing award-winning technology to transform digital communications and advertising content, including Link, the world’s largest and fastest free public Wi-Fi network. Intersection is the meeting point between the digital and the physical world, enhancing users’ intercity journeys and helping brands to drive revenue and boost engaging content, rooted in real-world locations and physical context.

Private Equity

INFRASTRUCTURE

Infrastructure is among Aurec Capital’s target investments, generating a steadily growing income in the long-term. Aurec Capital holds a stake in one of Israel’s central toll roads on the six-lane express Highway 6, now in operation for several years. Highway 6 was the first of its kind project in Israel and deemed a major success both operationally as well as financially.

Aurec Capital also holds a stake in Minrav Group, one of Israel’s largest real estate, engineering and infrastructure groups. From the building of airport terminals, museums, retail and office buildings, to entire residential neighborhoods and an array of income-producing properties. The group also specializes in complex industrial and infrastructure projects such as sewage treatment plants, highways, bridges and tunnels.

Private Equity

E-Commerce & Retail

The group has been very active in the E-commerce and Retail sectors for almost a decade, with a focus on consumer goods and the development of E-commerce platforms. Major businesses include Hong Kong-based Beauty Express, a fast-growing retail and online distribution company of skincare and beauty products worldwide.

Ecstorm, a leading cross border E-commerce platform, distributing international brands in the Chinese market.

Steimatzky, Israel’s leading destination for books, magazines, toys & games, music, and related products sold online and in over 130 stores.

Shoesonline, a digitally native fashion and lifestyle e-commerce platform, that connects international brands with Israeli buyers as one of the Big Two largest online fashion marketplace of its kind in Israel.

toMix, a digital trading platform, creating and producing original and unique mixed experiences and content in the fields of music, culture, culinary, tourism and more

Private Equity

INDUSTRIAL

Stone Canyon Industries is a global industrial holding company whose family of companies comprises market leaders in mission-critical industries that improve lives around the world. Stone Canyon Industries’ current holdings include a few verticals: SCI Rai

Private Equity

OIL & GAS

The energy sector is constantly in demand; the group believes global energy consumption will experience double-digit economic growth in the medium and long term. The group is investing in Grade 5 Oil, a U.S. based company that owns oil wells in southern California.

Private Equity

SHIPPING & LOGISTICS

A well-established shipping service provider, K.S.S. offers a wide range of international services with a local agency that ensures the smooth operation of coordinating port services, repairs, regulatory assistance as well as logistical and technical support. The company also provides chartering and brokering services including cargo and vessel surveying services, supervision, and quality inspection.

EARLY-STAGE INVESTMENTS

In 2014, the group established the Spinach Angels Fund,

bringing together seasoned industry veterans and entrepreneurs to co-lead investment initiatives and offer support to promising Pre-Seed Israeli tech companies. The Spinach Angels Fund focuses on SaaS technology companies and provides guidance and financial assistance to entrepreneurs of the most innovative Israeli companies in early-stage funding.

DIVERSIFYING OPPORTUNITIES

Aurec Capital seeks to diversify investment opportunities to complement its growing network strategy and build long-term partnerships driven by the most brilliant founding teams across a wide range of industries. To this end, the group invests in companies with secured proof-of-concept and in the scale-up phase of operations. This includes educational experiences as developed with The Squadron.

WorkShop, the co-working space in Camden, London and Tel Aviv, Israel that offers flexible and innovative ways for creatives to dream and create.

The group’s support for the EZbra initiative demonstrates its commitment to back long-term well-being and health-driven projects.

INCOME PRODUCING

DEVELOPMENT

The group invests in high-impact residential development projects in Poland and Australia. In such engagements, the group initiates the projects and manages the development process from start to finish, creating safe, spacious, and striking spaces. Utilizing its Poland-based subsidiary,

Aurec Home, the group is currently developing high-standard residential projects that include over 4,000 apartment units and plans to expand.

Cross Sector Multi-Stage Investments

INNOVATION

Aurec Capital is an active scout and financer of Israeli technology companies, seeking pioneering innovations in technology and developing them with a far-reaching network of long-term partners.

Years of venture capital activity led to the founding of the Spinach Angels Fund in 2014. Steered by a team of industry veterans and serial entrepreneurs, the fund invests in companies in the pre-seed and proof-of-concept stages, and provides its business expertise and financial backing to Israel’s most innovative entrepreneurs.

Building Roots From The Ground Up

INFRASTRUCTURE

The group holds a stake in Minrav Group, one of Israel’s leading real estate, engineering, and infrastructure construction groups. In addition, the group invested in Highway 6, Israel’s largest toll road and the first of its kind, deemed both an operational and financial success.

Global Reach / Europe

Over the last decade, the group has undertaken investments as a sole owner or lead investor and Sponsor alongside influential and leading institutional bodies, acquiring high-value properties. These properties include office, retail investments, and apartment rentals in prime locations in Germany where the group manages deal sourcing, transaction administration and complete asset management services.

CORPORATE OCCUPIERS

The group’s Asset Management arm co-finances substantial-scale office buildings in high-demand business hubs across Germany’s most important cities with major tenant leases. Notable investments include:

The Gothaer Headquarters building located in one of Köln’s most expensive financial centers and headquarters of the Gothaer Group with a net area of 100,000 square meters.

Eschborn Plaza is located in the Eschborn district of Frankfurt am Main – Germany’s fifth-largest city and financial capital. The sleek building houses EY’s corporate headquarters with a net leasable area of 42,000 square meters.

Bürohaus Bockenheimer Warte office building, located in Frankfurt, comprising a net leasable area of 35,000 sqm (sold in 2018).

As a lead investor and Sponsor, the group continues to closely monitor the properties and manage the facilities’ performance.

RETAIL

The group has honed in on potential opportunities related to DIY concept stores and shopping centers with consumer demand continuously growing in recent years. The group succeeded in establishing strategic business relations with its two mega-player tenants: OBI, the leading retail chain and mega German retailer, Toom.

PRIVATE RENTED SECTOR (PRS)

The group holds a portfolio of several residential properties in Berlin (Kreuzberg, Moabit, and Friedrichshain) as well as several commercial spaces with additional development potential. These properties generate a stable, high yield and are long-term income-producing assets.

Global Reach / Europe

POLAND

Leveraging Poland’s stellar economic performance, supportive business economic policies, and highly educated workforce, Aurec Capital founded a real estate development company in 2010 that developed and sold thousands of residential units in Warsaw and Krakov.

Under the leadership of Aurec and official partnerships with sound institutional investors, the group has launched several Private Rented Sector (“PRS”) projects as a long-term investment vehicle. Aurec Capital’s goal is to establish itself as an innovator and leader of PRS and Residential development.

Poland

PRS

Backed by a highly diversified international team, LiveUp is a Private Rented Sector (PRS) lifestyle brand with a portfolio of residential projects across Poland – and among the first entrepreneurial projects of its kind to launch in the city of Warsaw. An innovative residential concept with services and amenities unique to the Polish market, Aurec Capital acquires, manages, and leases the properties. Alongside its current property portfolio in Warsaw, Aurec Capital’s goal is to grow the PRS model substantially to include additional acquisitions and management of assets, with an estimated several thousand apartments in diverse locations expected to generate long-term returns.

Poland

Development

Aurec Home is the group’s development arm that develops unique residential projects in Poland with two large-scale residential projects currently under development consisting of 4,000 apartment units, aiming to take contemporary living to the next level. Projects in development are located in the fast-developing areas of Warsaw and in strategic locations that also offer the advantage of easy access to urban services.

APAC

China

Notable investments range from consumer goods to high-tech agriculture businesses. These include:

Beauty Express (“BE”), a Hong Kong-based rapidly growing retail and online distribution platform of skincare and beauty products with a vision to become a regional leader in Asia Pacific. BE developed its self-owned brands A80, Funderm, The Mineral Boutique, which are distributed worldwide, and is an exclusive APAC distributor of several cosmetic and hairstyling brands such as amika, Premier, and Gratiae Renowned for its forward-thinking approach, Aurec Capital also invested in Ecstorm, a third-party e-commerce service provider that introduced digital strategies and online store operations in China, powered by platforms such as Amazon, VIP, and Kaola. Ecstorm services more than 100 B2C companies and 1000 O2O merchants including 20 international companies and its goal is to become China’s leading provider of cross-border e-commerce services in the next few years.

Together with its Chinese partner, the group established Goldrich, a hydroponic agriculture company. Based on advanced Israeli agriculture technology the farm incorporates industrial agriculture, international food safety standards, and unparalleled quality, catering to top tier restaurants and high-end channels in China.

APAC

AUSTRALIA

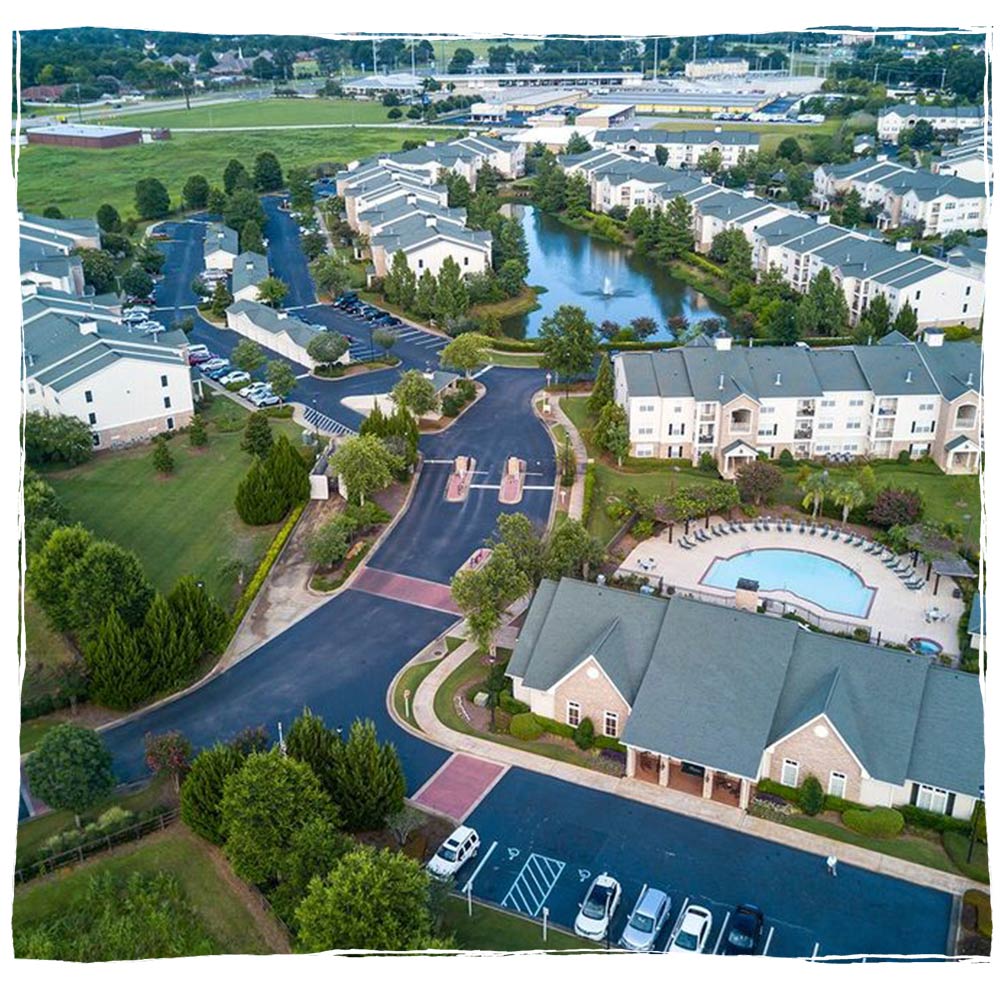

Up to date, several hundred residential housing units in the suburbs of Melbourne sold successfully including the Heidelberg-One project, Lakeside, Upper Point Cook, Springvale, and The Haig. Each luxury residential project is located in strategic positions that offer an optimal quality of life with a balance between accessibility, comfort, space, and privacy. The group plans to expand its portfolio with additional projects in the pipeline.

APAC

NEW ZEALAND

Aurec Capital owns 260 square kilometers of agricultural land in New Zealand used both for agricultural farmland as well as for tourism development. Additional developments are in the pipeline with the group’s land plots.

USA

Residential

Aurec Capital is actively growing its footprint in New York by cherry picking residential buildings for the long term.

From sourcing and underwriting to acquiring, financing and managing, Aurec Capital does everything inhouse with teams located firmly on the ground.

Specializing in opportunistic acquisitions, renovations, repositioning, and management of apartment buildings in NY, our strategy is to create value in underperforming residential buildings.

Striving to provide quality apartments in a wide variety of key locations, Aurec Capital works directly with architects, engineers, service providers, contractors, and suppliers to maximize investment and construction outcomes.

USA

COMMERCIAL REAL ESTATE

Aurec Capital has been an active owner and asset manager in the U.S real estate market since the early 2000s, owned and managed 10 well-positioned properties that consist of more than 1,300 residential units and approximately 1,000,000 square feet of office space (over 2.3 million square feet combined). The group’s portfolio is diverse and consists of large-scale multifamily assets in NYC, Georgia, and Alabama, alongside high-quality office building in prime location in Philadelphia.

As a strategic long-term owner and asset manager, Aurec Capital manages its assets in unison with its local partners, all of which have a proven record of accomplishment and deep familiarity with respective local markets.

USA

MULTI FAMILY

Aurec Capital Multi Family business was formed for the purpose of acquiring, owning and managing a portfolio of diversified income producing rental properties. Current strategies include core, core plus and value-add across several locations in the United States.

USA

PRIVATE EQUITY

With its mission to diversify investments and build a strong international network, Aurec Capital has secured strategic partnerships across several key industries, looking at those with long-term growth and continuous, daily demand – from digital communication platforms, road infrastructure, and the pharmaceutical industry.

PRIVAT EQUITY

Intersection

Stone Canyon

Sca Pharma

Grade Oil 5

The Khan and Meitar families founded the multi-family investment firm Aurec Group in the late 1960s. Together they established pioneering and successful companies including Golden Pages Israel’s Yellow Pages, AMDOCS, AIG Israel, Yellow Pages Romania, Golden Lines cable company, 012 internet company, Med One submarine fiber optic cable, and Maxmedia Group outdoor advertising. These investments were part of resilient partnerships with world-leading organizations and investors including AT&T, AIG, Telecom Italia and Bank Hapoalim.

Aurec Capital takes pride in the historic, long-standing strength of Aurec Group and its founding partners that together undertook some of the wisest, ROI-driving decisions during the rise of Israel’s high-tech telecommunication industry and inspired the founding of some of the world’s most influential corporations. The close relationship between both families remains, with ongoing business collaborations and investment projects.

Aurec Capital family office has headquarters in New York and Tel Aviv, as well as global offices in Berlin, Warsaw, and Shanghai.

Brands & Partners

Our Story

UPHOLDING

ALTRUISTIC VALUES

We value people and diversity, principles that we uphold in the way we do business and the way we view our business investments. Throughout the years, we have woven philanthropic engagements into the fabric of our endeavors. The group supports the Academic Program advocating for higher education for thousands of disadvantaged students, as well as the Prostate Cancer Foundation for Israel.

Our Story

OUR LEGACY

Over the course of four decades, Aurec Group’s international business activities instilled an entrepreneurial spirit in the succeeding generations, demonstrating how strong family values, a people-driven philosophy, resounding trust, and open-mindedness help to cultivate a winning business environment that considers all opportunities, sees no boundaries to creativity and innovates its own path. Never following trends, but creating standards of its own.

These are the seeds of Aurec Capital and our team prides itself on these core values, leveraging unstoppable strategic thinking and teamwork to expand our network, knowledge, and our circle of wealth in a constant feed of smart ideas and investments with long-term yields and potential for exponential growth in the future.